property tax advisory group

Red River Group has grown from two appraisers in 1999 to a team of over 35 professionals today. This program is designed to help you access property tax information and pay your property taxes online.

Property Tax Information Sussex County

We have placed a new secure outdoor drop box beside the mailboxes in the Judge E.

. Withum isnt just a job were a family and we carry that in everything we do. We live The Withum Way 10 tenets that define Withums. Boards Advisory Groups.

Securities and investment advisory services offered through DRM Wealth Management LLC a Registered. Montgomery County Real Property Tax - Personal Check Payment. To qualify for semi-annual payments the total of county taxes state taxes and special taxing district taxes must not exceed 100000.

Any media logos andor trademarks contained herein are the property of their respective owners and no endorsement by those owners of Megan Jones or Jones Advisory Group is stated or implied. Learn how Clearview Group effectively delivers Sales Use Tax services. Our services include Condo Reserve Fund Studies Market Rent Analysis Arbitration.

We specialize in real estate valuations real property consulting and property management. Resolve bills or liens for work done by the City on a property. Rebecca Greene - Manager Auditor Controller 5530 Overland Avenue Suite 410 San Diego CA 92123 Phone.

Determining your level of involvement is key to the tax treatment of the incomelosses that the real estate generates. Regulations rulings tax policy. Enter NA not applicable when appropriate.

858 694-2922 MS O-53. The check should be mailed to the following address. Commercial Industrial TELL ME MORE.

International Affiliate Transactions Involving Intangibles and Intellectual Property. Montgomery County Senior Property Tax Credit Senior Tax Credit The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence see the HOTC page for details. Starting July 1 2012 real property tax on small business commercial property can be paid on a semi-annual basis.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation bonds. Look up your property tax balance. Purpose-driven our tax accounting and business advisory professionals help businesses be more profitable efficient and productive in todays fast-paced tech-driven world.

Based on a technical correction under the new legislation qualified improvement property QIP placed in service in 2018 and after is now 15-year property and is eligible for 100 bonus depreciation providing many taxpayers with significant tax savings opportunities and incentivizing taxpayers to continue to invest in improvements. 858 694-2901 Fax. At BHL we offer expertise across the entire property spectrum.

Chambers County Tax Office 409-267-2763 Barbers Hill ISD Tax Office 281-576-2221 ext. Property from Federal Tax Lien Department of the Treasury Internal Revenue Service OMB No. August 17 2021 at 621 pm Angeles property tax roll will be assessed on the new value of 176 trillion.

Maurice Braswell Cumberland County Courthouse back parking lot off Cool Spring and Russell Streets. Montgomery County Maryland PO Box 824845 Philadelphia PA 19182. Information Service Update The Fair Entry Tax Advisory Services and Cashiers counters will re-open at the Municipal Building on Monday August 22.

If you have questions regarding your taxes or tax bills please contact one of the following Tax Offices. There are two types of property tax in the State of Arizona primary and secondary. Real estate by definition is a passive investment but depending on your level of participation you may be able to treat the rental as active or be classified as a real estate professional for tax purposes.

1205 Goose Creek ISDCity of Baytown Tax Office 281-420-4845. From site acquisition to repositioning rezoning and development. Taxpayers may also pay by mail with a check payable to.

We provide a national valuation service from coast to coast through an established network of capital city and regional offices in Western Australia South Australia Victoria New South Wales and Queensland. Certificate of Discharge of Property From Federal Tax Lien Advisory Consolidated Receipts 7940 Kentucky Drive Stop 2850F Florence KY 41042 Phone. Attachments and exhibits should be.

Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. Residential Communities TELL ME MORE. Clearview Group Named the 2021 Mid-Market Advisory Partner of the Year by Industry-Leading Workiva.

Sales and Use Tax. TB-100R Combined Group as a Taxpayer under the Corporation Business Tax Act. Use code enforcement numbers to request a payoff.

We offer a range of integrated strategic services including property advisory and funds management. Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation SDAT. Money Matters on WIBW Channel 13 is a paid placement.

Resolve business and incomeWage Tax liens and judgments. Convenience Fees are charged and collected by JPMorgan and are. Federal Tax Lien Advisory office for state where the notice of lien is filed General question about lien on deceased taxpayer IRS website.

DALLAS July 19 2022 Ryan a leading global tax services and software provider has announced the acquisition of Paradigm DKD Group LLC doing business as Paradigm Tax Group PTG a leading independent national provider of comprehensive property tax management servicesPTG provides taxpayers with a full suite of services including real and. The duties of the appraisal district include. Gross Income Tax.

Utilizing Automation During a Time of Labor Challenges. WBP Group works with both domestic and internationally-based private property owners and investors business and institutional clients. The City uses the tax levy not the tax rate to manage the secondary property tax.

The Planning and Development Services counter will remain at the Whitehorn Multi-Services Centre 3705 35. 1545-2174 Complete the entire application. Terms for agreement must be reached before discharge approved.

With Transfer California Property Tax being so valuable you want to dot your Is and cross your Ts. The City of Mesa does not collect a primary property tax.

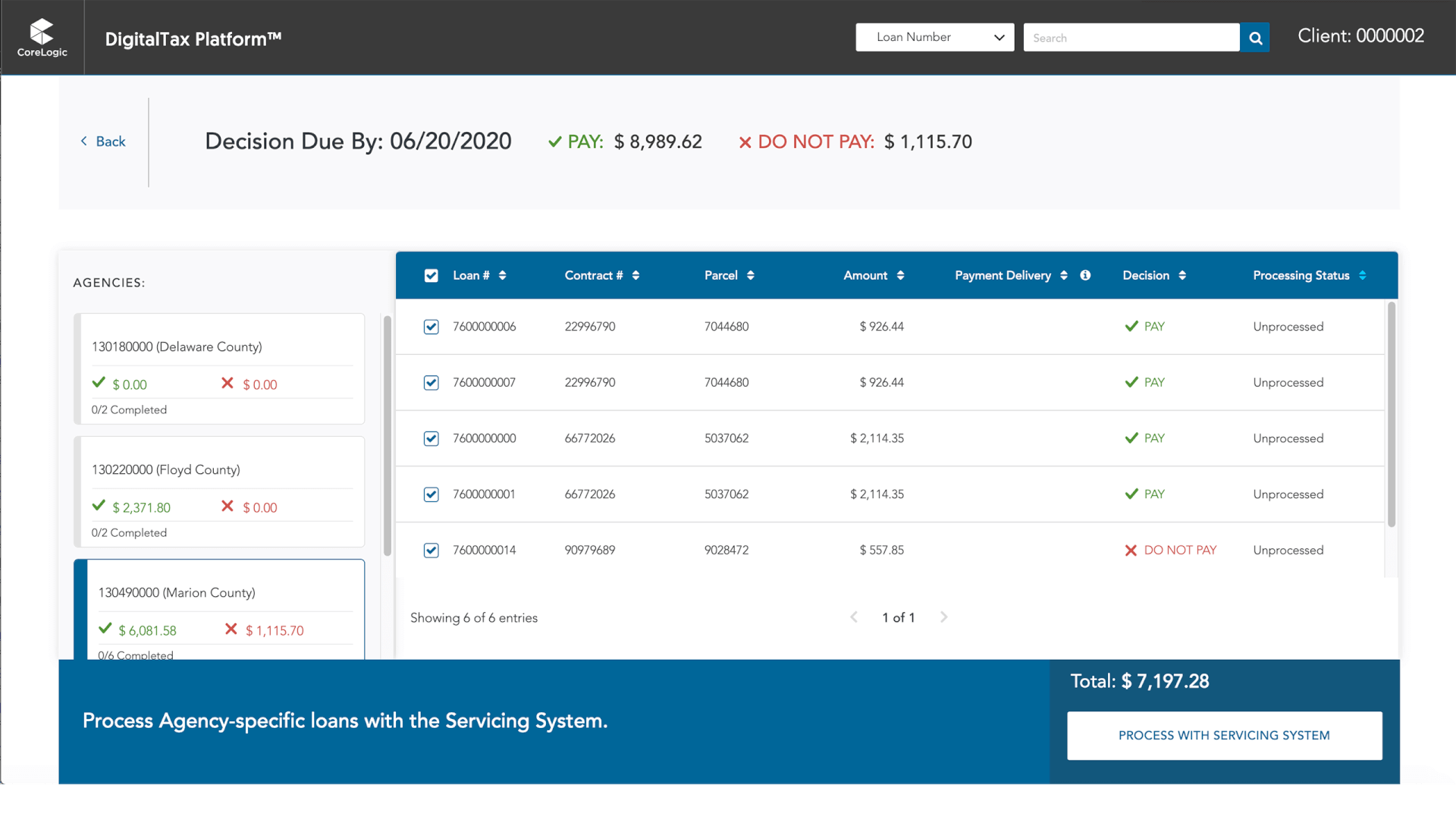

Commercial Property Tax Solutions Corelogic

Property Tax California H R Block

Property Taxes By State Embrace Higher Property Taxes

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

![]()

Property Tax Advisory Services Deloitte Us

Residential Property Tax Solutions Corelogic

Commercial Property Tax Solutions Corelogic

Real Property Tax Howard County

Property Tax Advisory Services Deloitte Us

![]()

Property Tax Advisory Services Deloitte Us

Real Property Tax Service Agency Fulton County

![]()

Property Tax Advisory Services Deloitte Us

Commercial Property Tax Solutions Corelogic

Florida Property Tax H R Block

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Property Taxes Department Of Tax And Collections County Of Santa Clara